Want to understand Abu Dhabi’s impressive economic diversification and tech sector growth? It’s largely fueled by strategic investment entities, primarily Mubadala Investment Company. This article dissects Mubadala’s strategies, highlighting its achievements, challenges, and wider implications for the global investment landscape. Discover how Mubadala balances profitability with Abu Dhabi’s overarching geopolitical ambitions and economic diversification goals across various sectors. For more on evaluating investment performance, see this guide on wealth fund valuations.

Mubadala Investment Company: A Deep Dive into Abu Dhabi’s Global Investment Arm

Abu Dhabi’s strategic push into diverse sectors, spearheaded by Mubadala, represents a compelling case study of ambition, calculated risks, and future potential. The company’s investment strategy has helped establish Abu Dhabi as a significant player in the global investment landscape. Let’s examine the inner workings of this influential organization, focusing on its investment portfolio diversification, risk management strategies, and geopolitical influence.

From Petroleum to Progress: Mubadala’s Origins and Evolution

Established in 2017 through the merger of Mubadala Development Company and the International Petroleum Investment Company (IPIC), Mubadala inherited a legacy of strategic investment. IPIC, founded in 1984, was created to advance Abu Dhabi’s petroleum wealth. Mubadala Development Company followed in 2002 with a mandate to further diversify the economy. Today, fully owned by the Abu Dhabi government and chaired by Sheikh Mansour bin Zayed Al Nahyan, Mubadala operates globally, managing a diverse portfolio across multiple sectors.

Building on a Solid Foundation: Diversification Across Key Sectors

Mubadala operates through four key investment platforms: Direct Investments, UAE Investments, Disruptive Investments, and Real Estate & Infrastructure Investments. These platforms enable Mubadala to engage in a broad range of activities, from direct investments in companies to large-scale infrastructure projects.

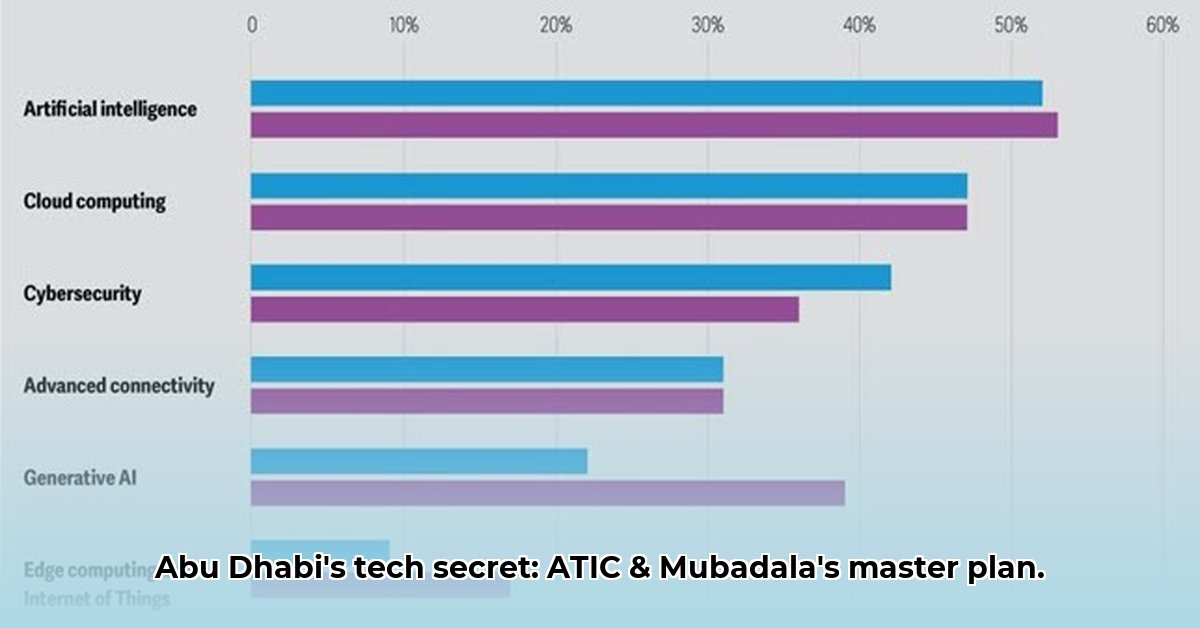

Technology

Mubadala’s early success was significantly driven by its investment in GLOBALFOUNDRIES, a semiconductor manufacturing company. This established a robust base for future expansion (semiconductor industry growth). Its vision goes beyond financial gains, aiming to establish Abu Dhabi as a major global technology hub, influencing its decisions and partnerships. Mubadala Technology’s Advanced Technology Investment Company (ATIC), formed in 2008, underlines Mubadala’s commitment to the sector.

Energy

Mubadala Energy (formerly Mubadala Petroleum) is expanding into liquefied natural gas, blue hydrogen, and carbon capture. The division operates in eleven markets and employs over 500 people, underscoring Mubadala’s commitment to both traditional and future energy sources.

Other Sectors

Beyond technology and energy, Mubadala holds significant investments in sectors such as healthcare, real estate, and financial services, reflecting its diversified approach to wealth creation and economic development. These diversified holdings provide stability and growth opportunities across various economic cycles.

The Global Chessboard: Geopolitics, Diplomacy, and Investments

Investing in global technology and other sectors requires navigating a complex geopolitical environment. Mubadala must manage international relations and regulatory scrutiny while striving for financial returns. This balancing act demands diplomatic skill and an understanding of international policy. Its approach continues to evolve alongside the geopolitical landscape. Navigating these challenges is crucial for sustained success.

Beyond the Balance Sheet: Assessing Mubadala’s Broader Impact

While financial returns are paramount, Mubadala’s investments also serve broader strategic goals for Abu Dhabi. These goals include:

- Economic Diversification: Reducing reliance on oil revenues by fostering growth in other sectors.

- Technological Advancement: Promoting innovation and technological capabilities within Abu Dhabi and the UAE.

- Global Influence: Enhancing Abu Dhabi’s position as a major player in the global economy.

More transparency in its investment strategies and risk management approaches would allow for deeper insight. Understanding how Mubadala mitigates risks and ensures long-term sustainability is critical for navigating the unpredictable global landscape.

The Global Tech Race: Competing for a Spot at the Top

Abu Dhabi is not the only nation investing heavily in technology. Countries like China, Singapore, and Saudi Arabia are also making significant investments, creating a competitive global arena. To stand out, Mubadala must establish a unique advantage. Its competitive edge may stem from long-term planning, access to capital, strategic alliances, and an ability to identify and nurture promising technologies.

High-Profile Investments and Partnerships: A Snapshot

Mubadala’s investment portfolio includes stakes in numerous prominent companies:

- Technology: GlobalFoundries, Waymo (Alphabet’s self-driving technology company), Turvo (logistics software), G42 (artificial intelligence company), Telegram.

- Financial Services: A 7.5 percent share in the Carlyle Group, Investcorp.

- Energy: En+ Group (green aluminum manufacturer).

- Infrastructure: MetrôRio (Rio de Janeiro metro).

Mubadala has also formed strategic partnerships with companies like Engie to develop digital platforms for electric vehicle charging and SoftBank Group regarding Fortress Investment Group

The Future: Charting a Course for Continued Success

Several factors will impact the future success of Mubadala. The Abu Dhabi government plays a vital role in providing guidance and oversight. The management team must skillfully navigate the global market, optimizing current investments and pursuing new opportunities in areas like artificial intelligence (AI), quantum computing, and sustainable technologies (future technology trends). A commitment to attracting and retaining top talent will also be critical.

A Plea for Transparency: Openness Builds Trust

Increased transparency is needed, especially regarding investment strategies, risk assessments, and performance metrics, to build trust and understanding. Transparency demonstrates a commitment to ethical and sustainable practices, vital for fostering lasting relationships with international partners and investors.

Call to Action: Strategies for Stakeholders

To achieve continual success, stakeholders must implement specific actions:

| Stakeholder | Short-Term Actions | Long-Term Actions |

|---|---|---|

| Abu Dhabi Government | Review investment performance; fine-tune investment policies; assess alignment with Vision 2030 | Establish a robust long-term economic vision; strengthen ESG (Environmental, Social, and Governance) compliance; foster collaboration between Mubadala and other Abu Dhabi investment entities; promote innovation and entrepreneurship within Abu Dhabi’s ecosystem. |

| Mubadala Management | Optimize current holdings; build strategic relationships with other firms; enhance risk management protocols | Develop well-defined exit strategies; pinpoint future high-growth sectors; recruit and retain top-tier talent; emphasize innovation; prioritize sustainable and responsible investment practices; increase transparency in reporting and operations. |

| Global Tech Companies | Explore investment opportunities; align with Abu Dhabi’s strategic vision; seek collaborative partnerships | Cultivate long-term relationships; navigate evolving global regulations; contribute to Abu Dhabi’s economic diversification goals; adopt ethical and sustainable business practices. |

| International Investors | Conduct thorough due diligence; assess risk-adjusted returns; evaluate alignment with investment objectives | Monitor Mubadala’s performance and governance; engage in constructive dialogue; promote transparency and accountability. |

In conclusion, Mubadala significantly influences the future of technology and other sectors globally. Its continued success hinges on transparency, flexibility, a clear, long-term strategic vision, and adherence to ethical and sustainable practices, enabling it to navigate the complexities of the global investment landscape. Open communication and ongoing investigation are vital to fully understanding its impact and investment trajectory.

Evaluating Mubadala’s Investment Strategies Against Competing Sovereign Wealth Funds

Abu Dhabi’s sovereign wealth funds (SWFs), especially Mubadala, are major players in global finance. How do their strategies compare to competitors like the Government Pension Fund of Norway (the world’s largest SWF) and other prominent SWFs? Let’s analyze the key factors that define their performance (sovereign wealth fund performance indicators) and strategic approaches.

Understanding the Landscape: Abu Dhabi’s SWF Ecosystem

Abu Dhabi’s SWF ecosystem includes Mubadala, ADIA (Abu Dhabi Investment Authority), and ADQ (Abu Dhabi Developmental Holding Company), collectively managing a significant portion of global capital. While precise figures fluctuate, these entities collectively manage assets estimated to be well over $1 trillion (as of late 2024/early 2025). This capital supports Abu Dhabi’s economic diversification, moving away from oil and towards technology, renewable energy, and other strategic sectors, consistent with Vision 2030.

The funds exhibit different investment strategies. ADIA typically favors a more conservative approach, while Mubadala often takes on greater risk, investing in cutting-edge ventures and early-stage technologies (early-stage investment strategies). ADQ focuses primarily on developing Abu Dhabi’s local economy. This diversity can provide risk mitigation across different investment vehicles.

Evaluating Investment Strategies: A Comprehensive Framework

Evaluating Mubadala’s investment strategies against competing SWFs requires a comprehensive approach. A simple comparison of raw numbers isn’t sufficient. Consider this framework:

- Investment Mandate and Alignment with National Goals: Do the investments effectively support Abu Dhabi’s economic diversification objectives as outlined in Vision 2030? Are they strategically positioned to foster innovation and long-

- How To Create Free Electricity Using Home Renewable Sources - January 30, 2026

- How to Produce Electricity at Home for Energy Independence - January 29, 2026

- How To Create Electricity At Home For Energy Independence - January 28, 2026