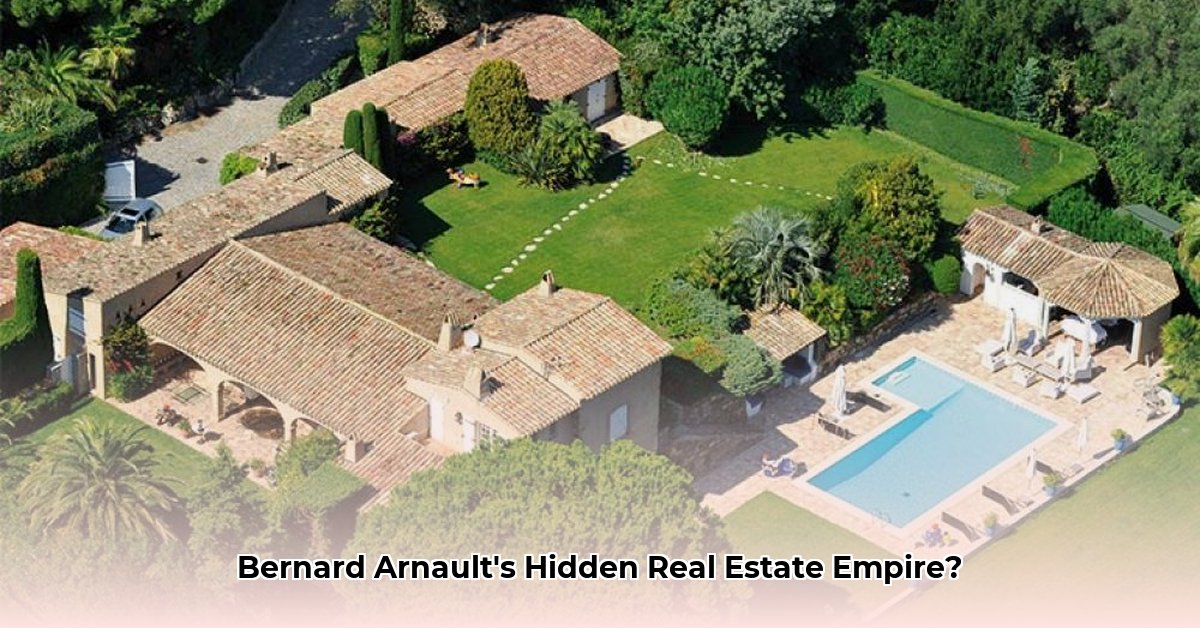

Bernard Arnault’s name is synonymous with luxury and immense wealth. For insights into other high-net-worth individuals’ real estate strategies, see this example. This article delves into his impressive real estate portfolio, exploring his properties worldwide, from the rumored $200 million Parisian mansion to exclusive estates in Beverly Hills and a private island. We will analyze how his real estate investments reflect his personal style and strategically contribute to his vast business empire. It’s a look at building an empire, one property at a time, and the insights we can glean.

Bernard Arnault House: A Peek Inside the Life of a Billionaire

Bernard Arnault, Chairman and CEO of LVMH (Moët Hennessy Louis Vuitton), the world’s largest luxury goods company, possesses an enviable collection of homes across the globe. Details about his personal life and real estate holdings are necessarily scarce, reflecting his famously private nature. Let’s explore what is publicly known about his properties and investment strategies.

Parisian Paradise: More Than Just a Palatial Mansion

Arnault’s primary residence is widely believed to be a stunning mansion in Paris, valued at approximately $200 million. This expansive estate, rumored to span 12 acres along the Seine, underscores his success and discerning taste. While reports corroborate its value and prestigious location in the 8th arrondissement, specific details about the interior design, square footage, and ongoing renovations remain largely undisclosed. Some estimates suggest renovation costs could range from $50 million to $500 million, reflecting the ambition to construct a new wing and upgrade existing structures, but confirmed information is elusive. This limited access to information highlights the intensely private nature of Arnault’s life and preferences. The property’s exterior hints at its grandeur, featuring limestone construction and a bronze door flanked by lion sculptures.

Beyond the Champs-Élysées: A Global Property Portfolio

Arnault’s real estate ventures extend considerably beyond France. He owns a substantial property in Beverly Hills, California, reportedly acquired for $84.5 million in late 2021. This residence is strategically located in the exclusive Trousdale Estates neighborhood, known for its privacy and high-profile residents. His portfolio also includes Indigo Island in the Bahamas, rumored to be worth $35 million. This 133-acre private island offers ultimate seclusion, providing an ideal retreat far from public scrutiny. These acquisitions reflect a carefully considered global investment strategy, diversifying his assets across key locations worldwide and securing havens for personal respite.

More Than Just Homes: Strategic Real Estate Investments

Arnault’s real estate acquisitions are inextricably linked to his business empire, LVMH. The reported purchase of the Soltykoff Hotel near Place Vendôme exemplifies this synergy. This strategic investment strengthens LVMH’s brand presence in a desirable location, blending personal preference with calculated business opportunities. Moreover, LVMH’s hospitality brands, such as Cheval Blanc, further integrate real estate into the company’s overarching strategy, offering luxurious accommodations in prestigious destinations, thereby creating a seamless brand experience.

The Missing Information: Acknowledging What We Don’t Know

While many accounts celebrate the extravagance of Arnault’s properties, specific and verifiable details remain elusive. Pinpointing the exact square footage, detailed amenities, or comprehensive interior design features is challenging. Reports vary widely, adding a layer of realism to the narrative. It reminds us that even billionaires maintain aspects of their lives they choose to keep private, thus preserving a sense of normalcy and control. This ambiguity does not diminish his portfolio’s impact but instead adds an element of mystique. Public knowledge of Arnault’s complete real estate holdings is further complicated by the use of trusts and holding companies to obscure ownership.

Actionable Intelligence: Lessons From Arnault’s Real Estate Strategy

Arnault’s real estate acquisitions offer valuable insights for diverse audiences. High-net-worth individuals can learn from his global diversification strategy, prioritizing prime locations and long-term value appreciation. Real estate developers can analyze his preference for strategic locations, luxurious amenities, and the integration of art to enhance property value and appeal. Luxury brands may gain insights into brand enhancement through strategic property acquisitions, aligning real estate investments with overall brand positioning. Even art collectors and investors can study the potential value appreciation of artwork within such high-value residences.

The Bottom Line: More Than Just Real Estate Investments

The mystery surrounding aspects of Arnault’s real estate portfolio enhances its intrigue. The lack of complete information underscores the privacy maintained by highly visible figures. His collection offers a glimpse into the life of one of the world’s wealthiest individuals, showcasing his impressive lifestyle and understanding of luxury and smart investments. Ultimately, Arnault’s properties represent a lifestyle, a legacy, and an astute business strategy – a reflection of the man himself. They are not merely places to reside but rather carefully curated assets that reflect his refined taste and strategic vision.

How Bernard Arnault’s Real Estate Investments Impact LVMH Brand Synergy

Key Takeaways:

- Arnault’s real estate strategy extends far beyond personal luxury; it’s about strategically investing to bolster LVMH’s brand image and ensure future growth.

- Properties situated in coveted locations like the Champs-Élysées and Beverly Hills serve to amplify LVMH’s global presence and prestige.

- Ownership of high-end hotels, such as Cheval Blanc, actively promotes and integrates the LVMH lifestyle experience, thereby deepening brand connections.

Prime Locations, Prime Brand Positioning

Arnault’s real estate portfolio mirrors the luxury landscape. Locations like Paris’ Champs-Élysées, Beverly Hills, and the French Alps are synonymous with exclusivity. These locations are strategic moves to elevate LVMH’s brand image by associating it with the epitome of luxury lifestyles, solidifying its position as a world leader. Strategic placement reinforces brand presence by associating the company with the world’s most desirable locations.

Beyond the Mansion: Hotels and the Integrated LVMH Experience

Arnault’s investment extends beyond residential properties and includes strategically acquiring and developing luxury hotels under the Cheval Blanc brand. This strategy focuses on creating a fully immersive LVMH experience. The synergies become apparent when one imagines shopping at a Dior boutique in Paris, then staying at a Cheval Blanc in the French Alps. Each property reinforces the other, creating a cohesive luxury narrative and brand integration. This creates a sense of exclusivity, quality, and prestige.

Mitigating Risk, Maximizing Financial Returns

The ultra-luxury market is susceptible to economic volatility. Arnault’s real estate strategy serves as a hedge against this instability. Prime real estate in stable markets represents a reliable long-term asset. This diversification, coupled with the inherent value of the properties, provides financial protection against headwinds impacting LVMH’s luxury goods sector. This approach serves as an example of mitigating risk through diversified investments.

Uncertainties and the “Premise Knock Down” Approach

While the overarching strategy is evident, some details remain unclear. For instance, the future uses of certain Champs-Élysées properties are not fully disclosed. Such lack of transparency is common among ultra-high-net-worth individuals and in off-market transactions. The strategic nature of Arnault’s actions should be emphasized, basing conclusions on observable patterns instead of speculating on individual acquisitions. This approach provides a more reliable and objective assessment of his strategy.

The Bigger Picture: Brand Synergy and Comprehensive Strategy

Arnault’s real estate investments are inextricably linked with the broader LVMH strategy, impacting everything from brand perception to long-term financial stability. His approach highlights the potential of strategic real estate holdings to enhance a luxury brand’s image, expand its reach, and mitigate financial risks within a dynamic global market. This multi-faceted approach warrants careful examination for anyone seeking to understand the convergence of luxury, real estate, and brand management.

Bernard Arnault’s Luxury Hotel Investments: A Strategic Analysis of LVMH Synergies

Key Takeaways:

- Arnault’s success is driven by strategic acquisitions, meticulous brand management, forward-thinking leadership, and astute financial decisions.

- LVMH’s diverse portfolio carefully cultivates each luxury brand, preserving its individual identity while enhancing overall synergy.

- The strategy centers on providing long-term value creation, emphasizing patience and sustainability.

The Arnault Approach: A Masterclass in High-End Hospitality

Arnault’s empire is a meticulously crafted ecosystem, acquiring legacies and stories interwoven into high-end brands. This extends to his hotel investments, where each acquisition is not merely a hotel but also carries a narrative, lifestyle, and brand extension. The strategic acquisitions are key, pinpointing undervalued gems, mirroring the Tiffany acquisition, as he transforms overlooked assets into symbols of opulence.

The Strategic Value of Hotel Investment

The strategic value of hotel investments extends beyond immediate profit. These investments are integral pieces of the larger LVMH puzzle, showcasing a stage for existing LVMH brands. The brand integration is immersive, featuring possibilities of Dior-themed suites, curated Dom Pérignon selections, and exclusive experiences tailored to mirror each brand’s identity. This immersive experience elevates brand value by creating complete brand experiences, resulting in enhanced customer loyalty.

Navigating Uncertainties: The “Premise Knock Down” Strategy

Even with limited information, patterns emerge that emphasize long-term value creation instead of quick profits. This approach is a marathon, not a sprint, and while some may critique the lack of public detail, it’s this precisely controlled narrative that strengthens the aura of exclusivity surrounding LVMH’s ventures, building brand mystique and commanding premium pricing.

Looking Ahead: Future Challenges and Opportunities

While the success of Arnault’

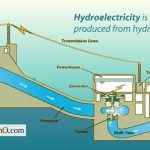

- Hydroelectric Power Basics How Water Is Used For Electricity - February 26, 2026

- Portable Water Generators Power Off-Grid Homes and Adventures - February 25, 2026

- Portable Hydroelectric Power Generators Light Up Off-Grid Living - February 24, 2026