Want to save money and go green with solar power in California? Great news! Even with the recent changes to the rules (NEM 3.0), there are still plenty of ways to get financial help installing solar panels. This guide will show you exactly how to take advantage of California’s solar incentives, rebates, and tax credits—making the switch easier and more affordable than you think. We’ll break down the process step-by-step, share smart tips for saving money, and give you real-world examples to make it all clear. Learn about future solar costs here. Let’s get started and discover how you can save big on your energy bills!

California Solar Energy Credit: Your 2025 Guide to Maximum Savings

Thinking about solar panels for your California home or business? That’s a smart move! California offers a bunch of incentives to make going solar more affordable, but figuring it all out can be a real headache. This guide simplifies the process and helps you snag the biggest possible savings with available solar rebates and tax credits.

Understanding California’s Solar Incentive Bonanza

California’s solar incentive programs are a mix of state and federal benefits, plus some extra perks from your local city or county. This means you could save a serious chunk of change, but you’ll need to do a little digging to find everything. Let’s break down the key programs and deadlines so you don’t miss out.

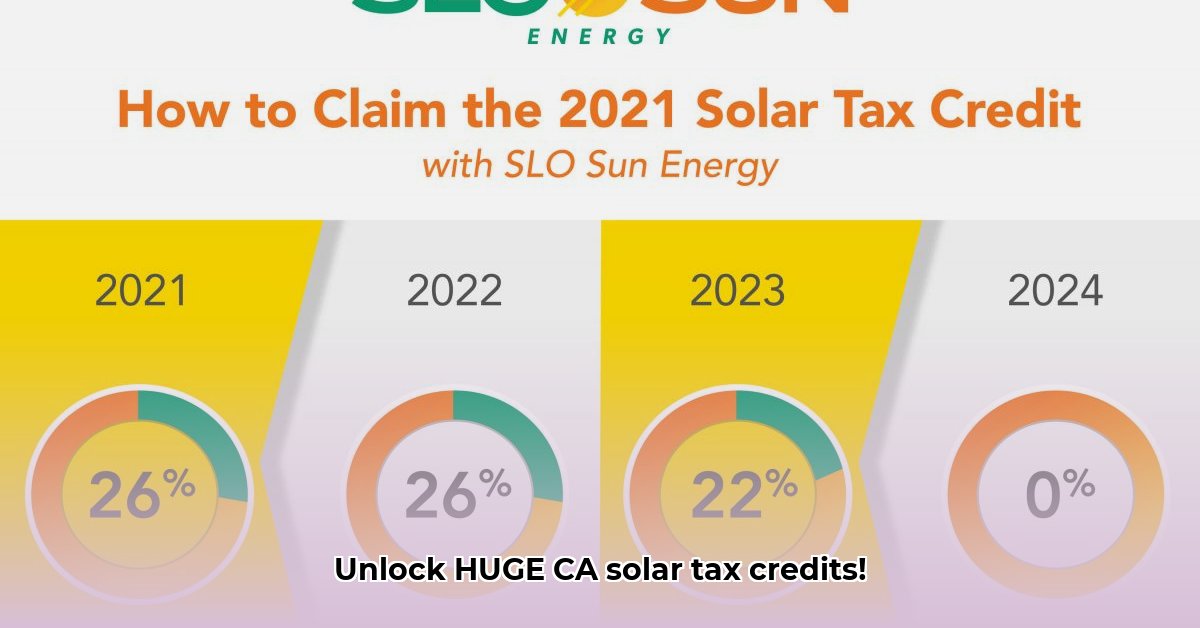

The federal Investment Tax Credit (ITC) offers a 30% credit on the total cost of your solar system. This significantly reduces the upfront investment and is available to homeowners across the state. The ITC applies to equipment, labor, and permitting fees. To claim the ITC, you must own the system, not lease it, and have sufficient tax liability to utilize the credit. If you don’t use the full amount in the first year, the credit rolls over to future tax years.

California offers a property tax exclusion for new solar energy systems. This exclusion prevents your property taxes from increasing as a result of the added value from your solar panels. The exclusion currently applies to new solar installations through January 1, 2027. Contact your county assessor’s office for specific details and application procedures.

Several utility companies and local governments offer additional rebates and incentives. For example, the Self-Generation Incentive Program (SGIP) provides rebates for battery storage systems. The rebates vary depending on the size and type of battery and are designed to encourage the adoption of energy storage solutions. Residents in disadvantaged communities may qualify for higher SGIP rebates, making solar more accessible for low-income households.

NEM 3.0: The New Rules of the Game

Net metering (NEM) has seen changes with the introduction of NEM 3.0. This new policy affects how much credit you receive for excess solar energy that you send back to the grid. NEM 3.0 reduces the value of exported solar energy, incentivizing homeowners to use as much of their solar power on-site as possible. This is a significant shift from previous NEM policies.

Does this mean solar is suddenly a bad idea? Not at all! It just changes the game a little. Battery storage is becoming even more important. Instead of selling your extra energy back to the grid at a reduced rate, you can store it for use later, maximizing your savings.

Your Step-by-Step Guide to Claiming Your California Solar Savings

Here’s a straightforward plan to help you grab those savings:

Step 1: Figure Out Your Energy Needs: How much energy does your home or business actually use? Review your past utility bills to assess your average monthly energy consumption. Understanding your energy usage patterns will help you determine the appropriate size of your solar system.

Step 2: Find a Reputable Installer: Get several quotes from licensed and insured installers. Check out online reviews, ask for references, and carefully compare system components and warranties, ensuring a reliable solar energy provider. Inquire about their experience with California’s incentive programs and NEM 3.0 regulations.

Step 3: Hunt for Local Incentives: This is super important! Your city or county probably offers additional financial assistance. Contact your local government and utility company to inquire about available rebates and incentives. Check websites for programs specific to your area.

Step 4: Factor in the Federal ITC: The ITC is a significant chunk of your savings. Understand how it’s calculated so you can budget accordingly and claim it when tax season rolls around. The ITC is a direct reduction of your federal income tax liability, so consult with a tax professional to determine your eligibility and how to claim the credit.

Step 5: Consider Battery Storage: As mentioned, batteries add even more value, especially with NEM 3.0. They let you use your stored solar energy during peak demand, greatly reducing how much you buy from the grid, improving return on investment. Evaluate your energy usage patterns and time-of-use rates to determine if battery storage is a worthwhile investment.

Step 6: Understand Property Tax Implications: Your property tax savings (or lack thereof!) depend on where you live and when your system is installed. Check the rules in your area to navigate property tax exemptions for solar installations. Contact your county assessor’s office for detailed information about the property tax exclusion and how it applies to your solar system.

Step 7: File Your Taxes Smartly: Make sure you claim the ITC and any other relevant tax credits or rebates using professional tax assistance. Use IRS Form 5695 to claim the federal solar tax credit. Keep records of all your solar-related expenses, including installation costs, permits, and equipment purchases.

Going Solar: Weighing the Pros and Cons

| Feature | Pros | Cons |

|---|---|---|

| Initial Investment | Government incentives and tax credits significantly lower the upfront costs. | Still a hefty initial investment, even with incentives, but with long-term potential savings. |

| Long-Term Savings | Lower energy bills throughout the solar system’s lifespan providing renewable energy benefits. | System maintenance and potential repair costs need to be factored into the long-term outlook. Batteries may need replacement after 10-15 years. |

| Environmental Impact | Dramatically reduces your carbon footprint, helping the planet through sustainable energy solutions. | Manufacturing and disposal of the panels have some environmental consequences which can be improved through ethical sourcing. |

| Home Value | Typically boosts your home’s value with energy-efficient home improvements. | The exact impact depends on your local market and the new NEM 3.0 rules, so local market research is beneficial. |

Making the Right Decision for You

The decision to go solar is personal. Think about your energy usage, the incentives available in your area, and the long-term cost of electricity. Don’t hesitate to consult with a financial advisor and a reputable solar energy professional. With all the California solar energy credits and other programs out there, going solar may be a financially smart move for many homeowners and businesses. Just remember to do your homework and act before those deadlines sneak up on you!

How to Maximize California Solar Incentives with Battery Storage

Key Takeaways:

- California offers substantial rebates for solar-plus-storage systems, providing increased financial assistance for going solar.

- The Self-Generation Incentive Program (SGIP) is your key to savings, helping to make green energy more accessible.

- Federal tax credits further reduce your costs with financial benefits for renewable installations.

- Understanding eligibility criteria is crucial, ensuring you get all credits available.

- Working with a knowledgeable installer streamlines the process guaranteeing appropriate procedures.

Ready to supercharge your solar savings? Let’s dive into how to maximize California solar incentives with battery storage. California is a leader in renewable energy, and its generous incentive programs make going solar—and adding battery storage—more affordable than ever by focusing on energy-efficient upgrades.

Understanding the California Self-Generation Incentive Program (SGIP)

The SGIP is your golden ticket to significant discounts on battery storage by using existing financial stimulus programs. This program offers rebates that can dramatically lower your upfront costs, making renewable energy more attainable. But it’s more than just a price cut; it’s an investment in energy independence and resilience, particularly important in wildfire-prone areas ensuring reliability for residents.

The SGIP provides rebates for eligible energy storage systems installed at homes and businesses. These rebates are structured to incentivize the adoption of clean energy technologies and reduce reliance on the grid. The program prioritizes projects that benefit disadvantaged communities and those located in high-fire-threat areas.

Think of it like this: SGIP is a financial springboard for your solar project. It helps you leap past the initial investment hurdle with state energy programs.

Navigating SGIP’s Nuances: Eligibility and Funding

While the potential savings are substantial, understanding SGIP’s requirements is critical to secure solar incentives. Eligibility depends on factors like your location, income, and even your health status if you apply for high-priority programs helping low-income residents.

Funding is limited, and certain high-rebate tiers fill up fast. Timing is everything to get financial assistance! SGIP uses a lottery or first-come, first-served system to allocate funding. Be prepared to apply as soon as the application window opens to maximize your chances of receiving a rebate.

- Step 1: Assess Eligibility: Use the official SG

- How to Produce Free Energy for Your Home - February 11, 2026

- How to Generate Electricity for Free at Home - February 10, 2026

- How To Produce Free Electricity By Generating Your Own Power - February 9, 2026